Monday Market Briefing - 30th November 2020

Politics are intrinsically linked to the pricing of commodity markets. Crude oil has been used as a tool to fight wars and barter trade deals, whereas energy-rich food commodities such as sugar and wheat have the brutal ability to provide feast or famine to nations.

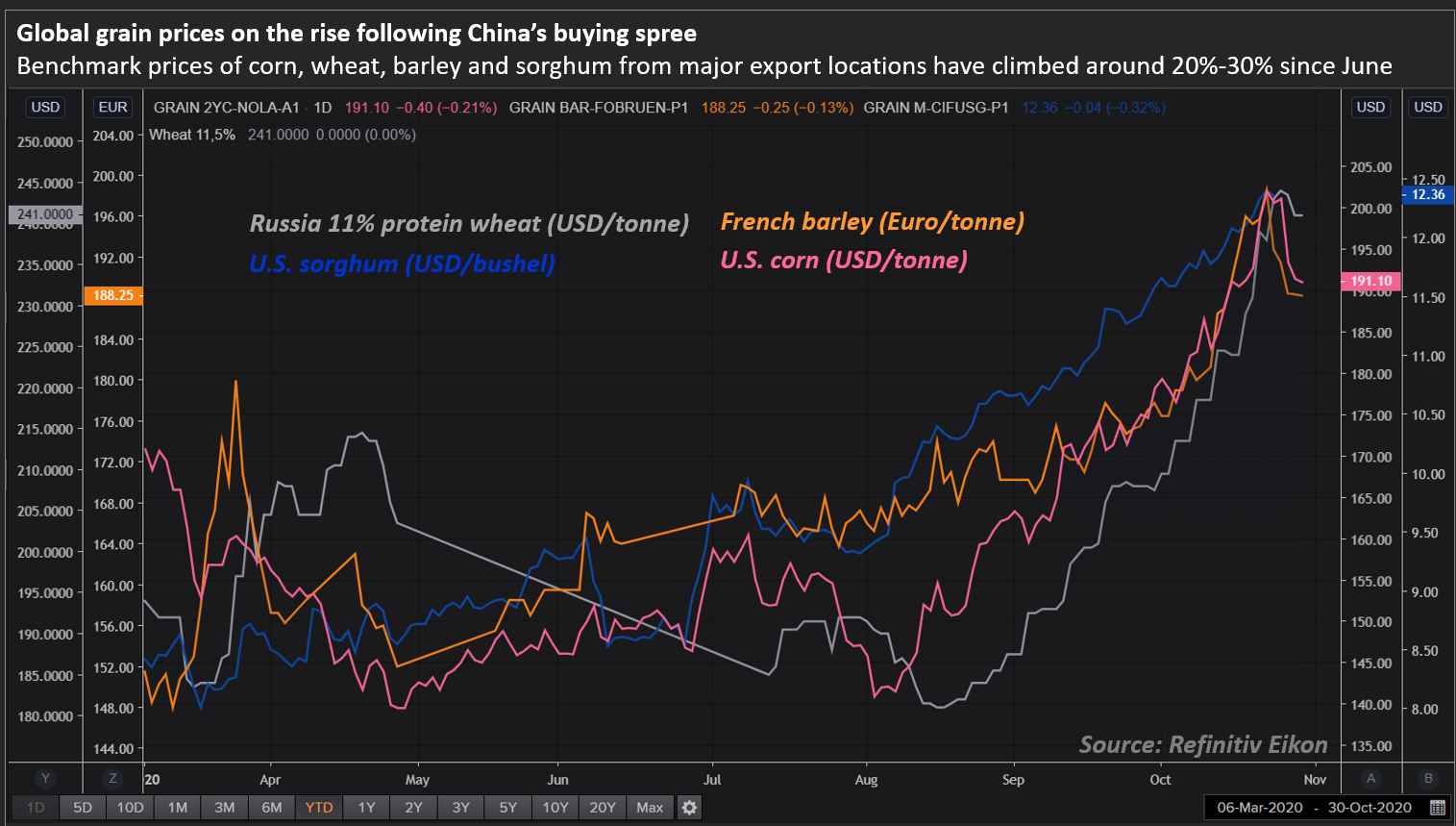

Chinese politics have recently had a larger effect on global grain markets than normal. As previously discussed, Australia exports the majority of their barley surplus to China – and with their insistence that China were responsible for the pandemic outbreak in Wuhan, this has prompted a trade war between the countries. China have instigated punitive import tariffs on Australian barley that effectively prevents any shipments into the country. Instead, China look to Europe for their supply of barley and Australia are forced to ship their barley to the Middle East. Both parties are hurt by this arrangement through higher commodity prices and larger freight costs (see chart).

Grain markets could accept this as a stand-alone punishment from China, with a potential of 3 mln MT of French barley forecast to be exported to China this season. The surprize is that China wish to extend this policy into Harvest 2021 and have already stepped in to purchase over 1 mln MT of French barley for new crop (July-Sept 2021). This ongoing European demand should keep values supported for both the remainder of old crop, and into next season. It also puts into question the validity of reported Chinese stocks of grain - particularly as China rebuild their pig-herd numbers following swine-flu.

We would expect a volatile week in grain markets as the US return from their Thanksgiving holiday, but expect values to be supported longer-term Jan-July 2021, particularly with a weaker sterling/euro exchange rate.