Monday Market Briefing - 30th May 2022

Markets found support after trying to continue the push lower early in the week – we ended Friday at about the same level we were at three weeks ago. After months of upward trend there is a sense we may have found a level of equilibrium for the time being. Deteriorating crop reports, particularly in Europe, help keep the positivity flowing, but perhaps the worst news of the war is well priced in now.

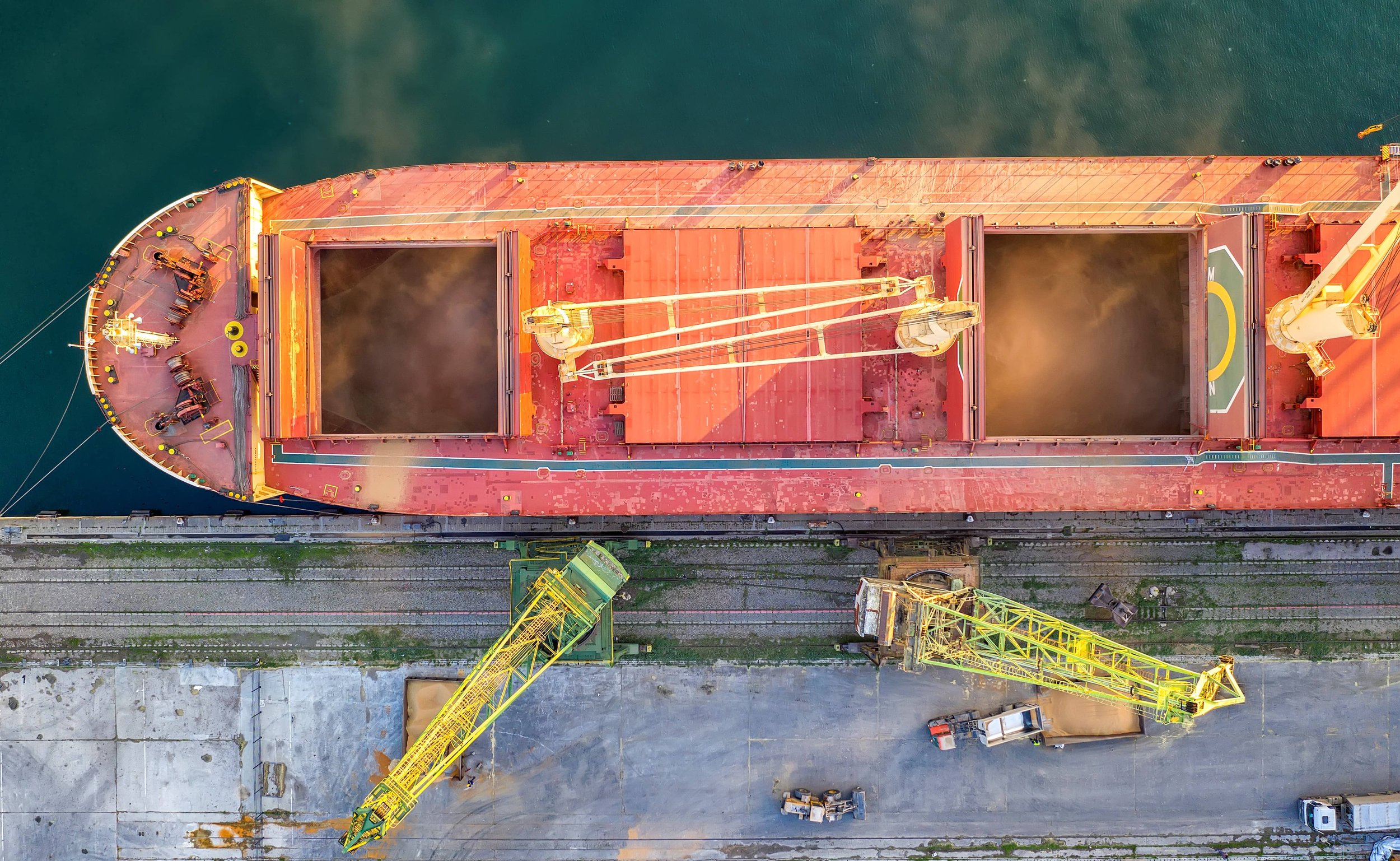

Markets are grappling for a handle on how 2022 crop international trade could play out. Suggestions that Russia might cooperate in enabling a safe passage for grain cargoes out of Ukraine was viewed with considerable scepticism both in terms of its likelihood and also its practical feasibility. It’s a bitter irony that Ukraine is enjoying some of the most favourable weather in Europe for its ‘22 crops - a fair proportion of which did actually get planted – but concern does grow for the handling of new crop at farm level if old crop is still blocking the system.

At home pretty much everyone has now had useful rain in May and UK crops now look very promising. In truth we don’t see anything all that worrying in the European weather right now, and the suddenly huge quality premiums particularly for malting barley look like a real opportunity. We know for a fact they wont stay this high if all European crops come through. Market direction for next few weeks then probably rests mainly on that delicate balance between buyer/seller enthusiasm on any given day, potentially a quiet one this week for the UK heading into the two day holiday.

Have a good week.